Save time and never miss a payment with our convenient auto pay option! Enroll today and enjoy hassle-free billing.

Cooperatives are not like for-profit companies that are owned by investors. As a member of Otsego Electric Cooperative (OEC), you aren’t just a customer, you’re also a part-owner of your Co-op. This means you get to vote on who will represent you on the Co-op’s Board of Directors and when the Co-op earns excess revenue or margin, you are allocated a portion of that equity.

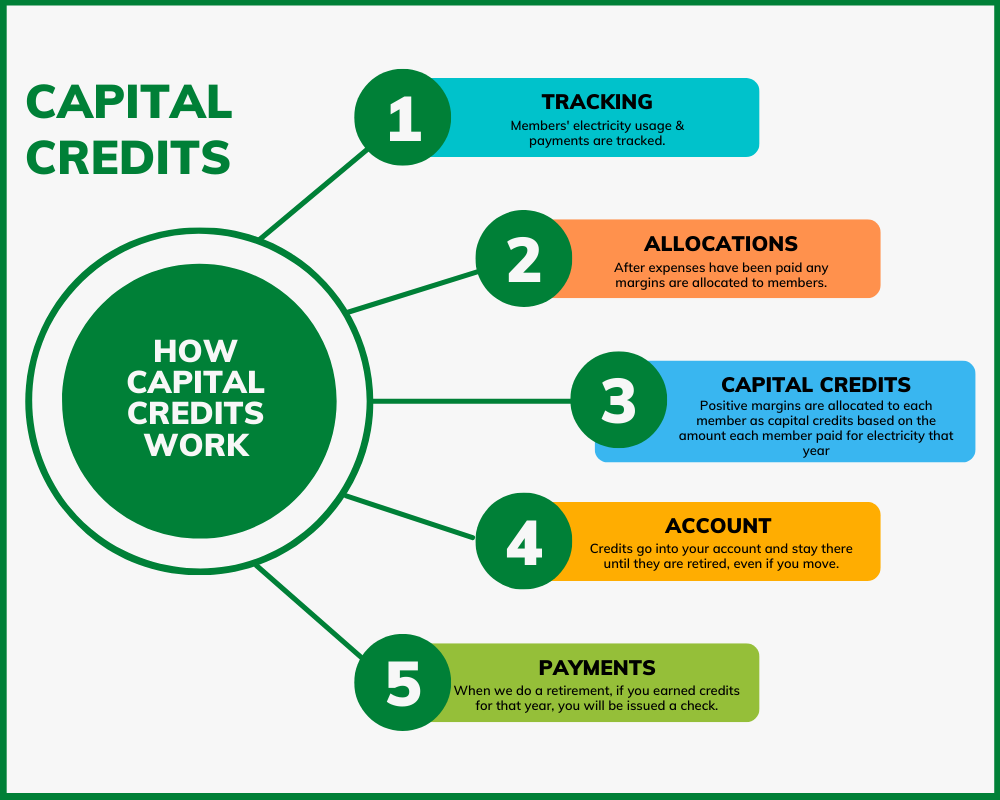

This equity is first used to fund capital projects to keep our distribution system safe and reliable but it will eventually be returned to our members when the Co-op’s finances allow. Member equity in OEC is represented by Capital Credits.

Member Capital Credits being returned is a large part of what distinguishes a cooperative from an investor-owned or municipal utility. As you use, you earn!